On Wednesday the 12th of April at 8:30 AM ET, the BLS is set to release the US CPI numbers for the month of March.

Here are some views on what to expect.

According to median analyst estimates, US CPI YoY is expected to cool off to 5.1% from 6%. The highest estimate is 5.4%, with the lowest at 4.9%, the MoM read is forecast to cool off moderately to 0.2% from 0.4% in February.

Core CPI YoY is expected to rise moderately to 5.6%, from 5.5%. The highest estimate is seen at 5.7%, with the lowest at 5.3%

JPMorgan

CPI YoY Forecast: 5.2%

Core CPI YoY Forecast: 5.7%

Dr. David Kelly

Last week’s employment report showed a slowdown in both job growth and year-over-year wage growth. This week’s numbers should reinforce this narrative, as we expect to see a decline in both month-over-month retail sales and year-over-year CPI inflation.

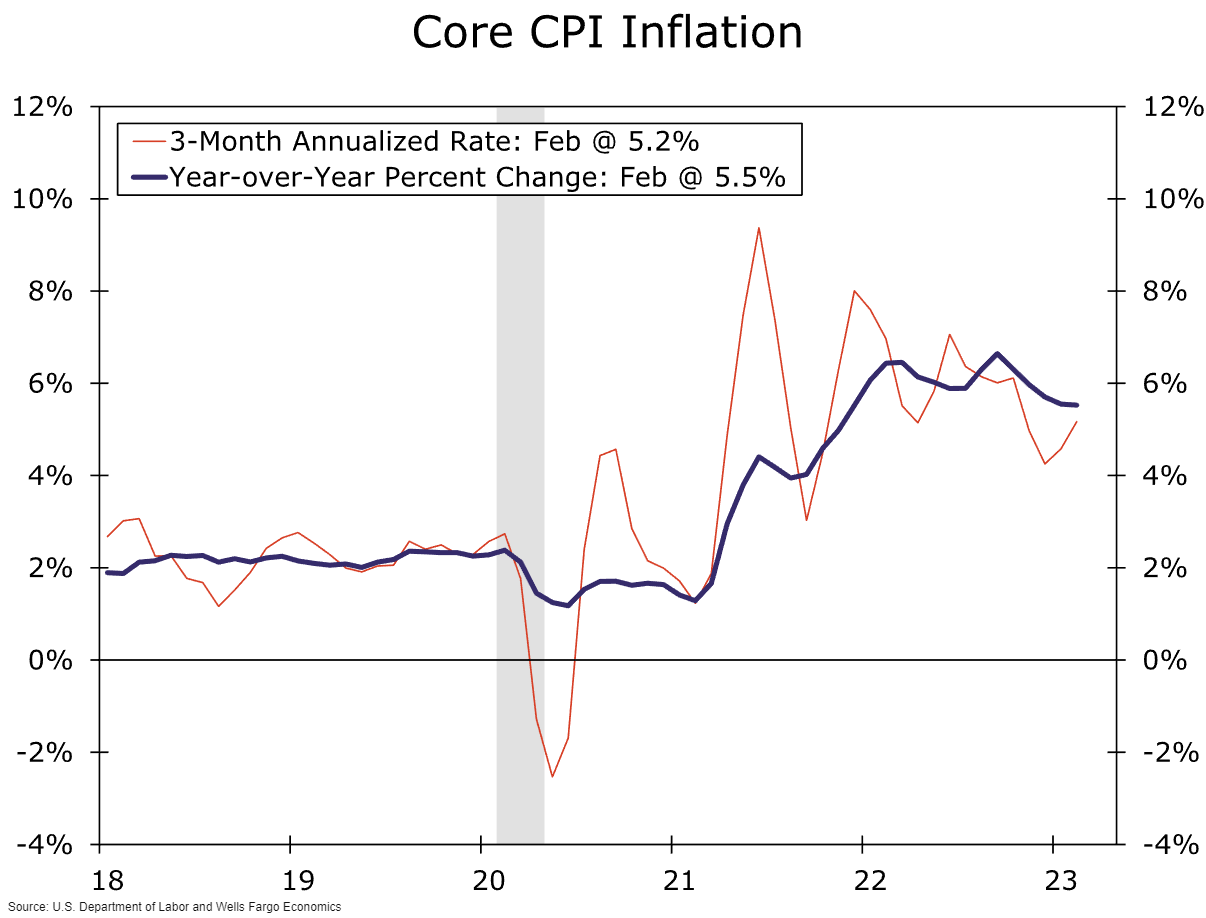

Wells Fargo

CPI YoY Forecast: 5.1%

Core CPI YoY Forecast: 5.6%

After rising 0.4% in February, we look for the month-over-month CPI to moderate to a 0.2% gain in March. With the initial surge in oil/gasoline prices stemming from Russia’s invasion of Ukraine a full year behind us, CPI when measured on a year-over-year basis should fall to 5.1% in March from 6.0% in February.

However, another elevated reading in the core CPI is likely to indicate that the recent trend in inflation is little improved. Excluding food and energy, we look for the month-over-month CPI to rise 0.4% and remain close to 5% on a three-month annualized basis. A further slowdown in core inflation is likely coming as the year progresses, but we doubt it will be evident in next week's CPI release.

Goldman Sachs

CPI YoY Forecast: 5.1%

Core CPI YoY Forecast: 5.6%

Praveen Korapaty

Rate hike odds in May should rise if CPI remains on track, but we do not see a near-term catalyst that would cause investors to price material odds of additional hikes.

Blackrock

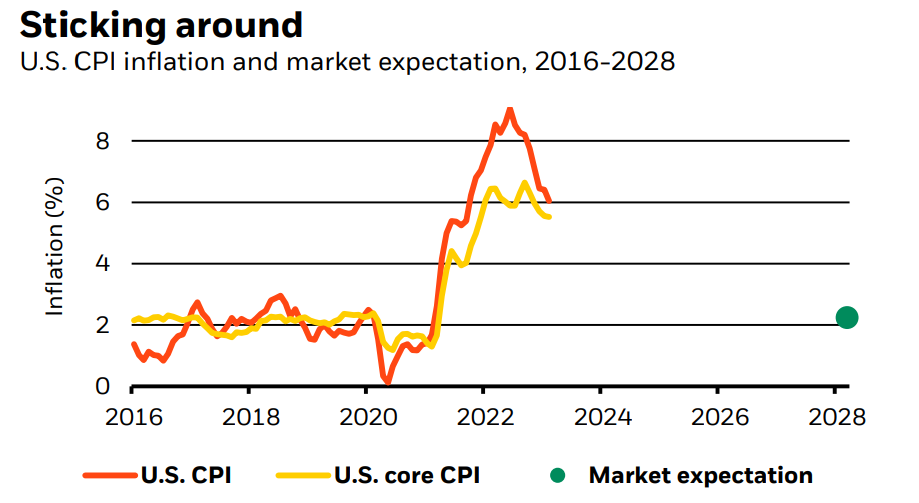

This week’s data is likely to show U.S. inflation staying sticky.

We think market pricing is underappreciating persistent inflation and took advantage of the dip in expected inflation in March to up our overweight.

Source: BlackRock Investment Institute, with data from Refinitiv Datastream, March 2023.

ING

Wednesday's CPI report is expected to show core CPI rising 0.4% MoM, more than double the 0.17% MoM rate needed overtime to take the US back to 2% YoY inflation. If that happens it is difficult to see the Fed pausing in May barring the re-emergence of financial system stress.

Bank of America

CPI YoY Forecast: 5.3%

Core CPI YoY Forecast: 5.6%

Previous Release

On March 14th, we saw the previous US CPI release, with the headline figures coming in broadly as expected.

US CPI MoM came in at 0.4% as expected, slightly down from January's 0.5%.

US CPI YoY was 6%, as expected, down from January's 6.4%.

US Core CPI MoM was 0.5%, a moderate uptick from the previous and forecasted 0.4%.

US Core CPI YoY came in at 5.5%, as expected, down slightly from January's 5.6%.

(S&P500 5M Chart, March 14th)

As one would expect, the market reaction to this data was muted, with some initial whipsawing, before a slow upside movement was extended in the S&P 500.