On Wednesday the 3rd of May at 2:00 PM ET, the Federal Reserve is set to release its latest interest rate.

According to CME Fedwatch as of 07:45 ET this morning, 84.1% of participants expect a 25bps hike at this meeting.

So attention will turn to the Rate Statement for clues as to whether this will be the last hike in this tightening cycle or not, and comments from Powell at the press conference.

Regardless, here are some views on what to expect.

ING

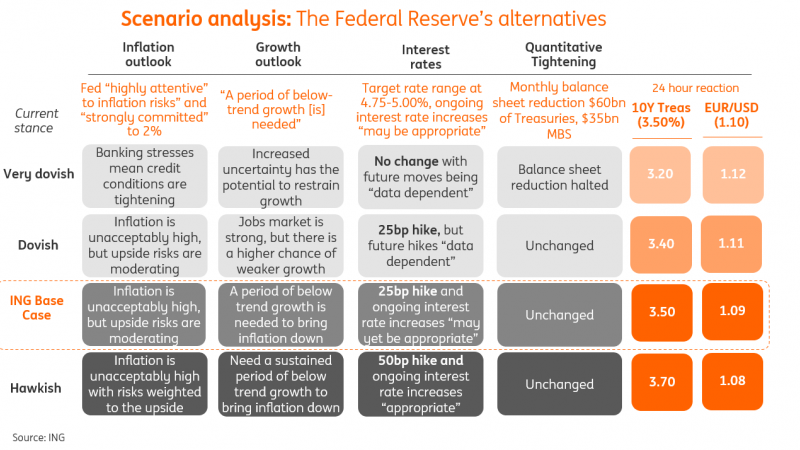

Inflation remains 'unacceptably high', but banking stresses are leading to a tightening of lending conditions, which will do more to slow the economy than the likely 25bp hike on Wednesday.

While the Fed will leave the door ajar for further hikes, the need for higher policy rates is highly questionable.

We expect 100bp of rate cuts before year-end. We do think this will mark the end of the Fed’s tightening cycle, but the central bank will be reluctant to explicitly state that.

Last month it switched its language from February’s “ongoing increases in the target range will be appropriate” to “some additional policy firming may be appropriate”. inflation has continued to run hot and the jobs market is tight while first quarter GDP was headlined by strong consumer spending.

Moreover, Federal Reserve officials’ comments have changed little over the past month, other than hints that the impact on credit conditions is being more readily acknowledged, with some officials, including the likes of Atlanta Fed President Raphael Bostic, openly talking about one more hike and then a pause. We strongly suspect that at the 14 June FOMC meeting, the Fed will adopt a hard stop as it did in January 2019 when it paused and talked of “patience” after just the previous month's warning to markets to “expect some further gradual increases”.

We strongly suspect that at the 14 June FOMC meeting, the Fed will adopt a hard stop as it did in January 2019 when it paused and talked of “patience” after just the previous month's warning to markets to “expect some further gradual increases”.

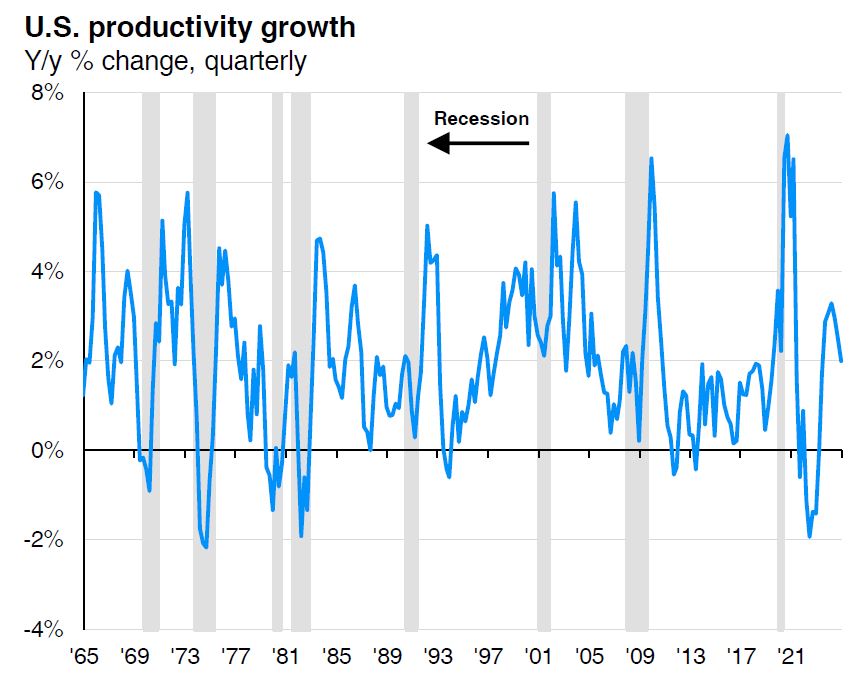

This is because we think recessionary forces are building rapidly, which will lead to rising unemployment and inflation falling quickly through late 2023 into 2024.

Blackrock

Income is back as a portfolio driver as we see interest rates staying high in the new regime of macro and market volatility.

In the US, it’s now evident in the financial cracks emerging from higher interest rates on top of rate-sensitive sectors.

We don’t see major central banks coming to the rescue of the economy with rate cuts this year.

We see the Federal Reserve and European Central Bank hiking rates again this week even as growth takes a hit.

The US two-year Treasury yield fell back near 4.0% even as the market eyes a Fed rate hike this week.

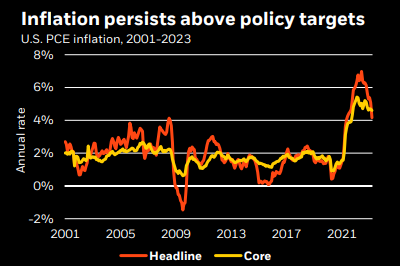

US PCE data showed consumer spending losing momentum over the course of the first quarter.

Strong US wage growth pointed to inflation settling well above 2% policy targets – why we believe hopes for rate cuts this year are misplaced.

Wells Fargo

We expect the Committee to hike the target range of the federal funds rate by an additional 25 bps on May 3, lifting the range to 5.00%-5.25%.

Our forecast anticipates one more quarter-point rate hike at the upcoming FOMC meeting on May 3 after which we suspect the Fed will remain on hold until the fourth quarter. Had we not encountered a banking crisis, a few more rate increases might have been in the offing. The recent difficulties in the financial sector, however, and the associated strain on the financial system diminish the need for further hikes beyond May, in our view.

So, the more gripping question these days has less to do with the specifics of the FOMC’s next meeting and more to do with when policymakers will eventually take back some rate hikes. When you look at the dot plot from the March meeting, among 18 current members of the FOMC, 17 of them have the fed funds rate at 5.00% or higher at year-end; one brave committee member has fed funds between 5.75%-6.00%.

In other words, the dot plot is saying "higher for longer" but markets are not convinced. The implied rate based on fed funds futures trading is hovering near 4.50%. Our own forecast splits the uprights with a year-end target of 4.75% for the fed funds rate.

JPMorgan

At the March meeting, 17 out of 18 FOMC participants believed the federal funds rate needs to be 25bps higher at the end of 2023 than its current target range of 4.75% to 5.00%. Going into this week’s meeting, the question is whether enough has changed over the last six weeks to convince a sufficient share of voting members to change their mind. Following early March’s regional bank stress, equity and bond market volatility has eased, while investors have gone from pricing in a 21% probability of a 25bps rate increase in May on March 13 to an 85% probability today. Economic data have been mixed, but the picture still broadly shows a resilient U.S. economy. Last week, 1Q GDP growth came in below consensus at a 1.1% annualized rate, with a sharp decline in inventory accumulation, continued contraction in housing and slowing business fixed investment, but strong 3.7% consumption growth.

Previous Release

On Wednesday the 22nd of March 2023 at 14:00 PM ET, the Fed hiked its interest rate 25 bps from 4.75% to 5%, as expected.