On Friday the 5th of December, at 8:30 AM ET, the BLS is set to release the latest US Nonfarm Payrolls and Unemployment Rate numbers for the month of December.

Here are some views on what to expect.

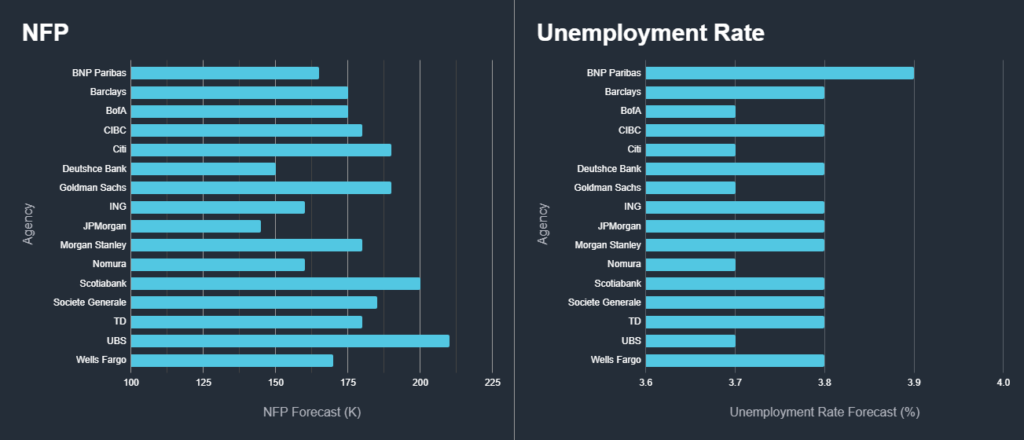

Here are some major investment bank's opinions on the upcoming jobs reports.

Wells Fargo

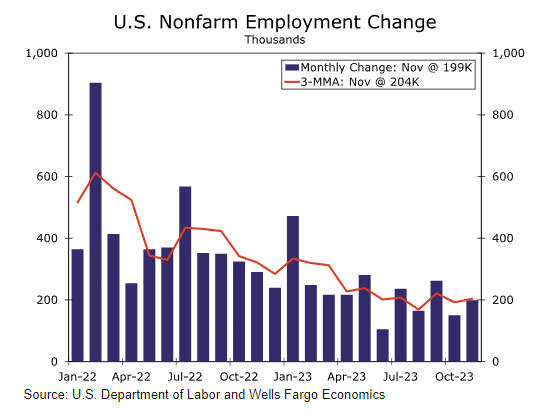

The headline nonfarm payroll number came in strong in November, beating consensus expectations with a print of 199K. This brought the 3-month average of monthly payroll gains up slightly to 204K, which, though a slowdown from the strong employment gains of early 2022, is still consistent with a strong labor market. Payroll growth benefited from the end of the United Auto Workers and Screen Actors Guild Strikes, with motor vehicles and parts manufacturing employment jumping 30K and motion picture and sound recording studios notching a 17K increase. Outside of payrolls, the unemployment rate fell to 3.7%, a decline of 0.2 percentage points, and average hourly earnings grew 0.4%.

In December, we forecast that the U.S. economy added 170K to nonfarm payrolls. This will represent a bit of a slowdown following a solid November print, but will be in line with the trend decline, albeit a bumpy one, in payrolls that has been in place since mid-2022. While the end to some of the strikes served to buoy employment data for November, the December employment data will not have the same luxury. We forecast the unemployment rate to rise to 3.8%, while we look for average hourly earnings to grow 0.3% on the month.

ING

October’s was much softer than expected, so there is cope for a bit of a recovery, but the trend is towards weaker hiring, as signalled in the recent Fed Beige Book and the rise in continuing jobless claims. The unemployment rate is expected to stay at 3.9%, but we soon expect it to break above 4%. Subdued wage growth should reaffirm the market’s view that the inflation pressures from the jobs market are weakening fast, aided by improving productivity growth.

JPMorgan

Barring a surprise in this Friday’s data, the unemployment rate has just wrapped up a 25th straight month below 4% - the longest streak of sub-4% unemployment since the late 1960s. This has been sustained by the addition of a very healthy 2.7 million payroll jobs over the past year. Meanwhile, although labor force participation for those aged 16 and over remains below pre-pandemic levels, this is largely an artifact of the aging of the baby boom. The participation rate for Americans aged 18 to 64 has, in recent months, climbed to its highest level since 2009.

This expansion in labor force participation has relieved some of the labor shortages that plagued American businesses in the aftermath of the pandemic. Although October job openings, at 8.7 million, were still higher than at any time before the pandemic, they were down substantially from the 11.2 million vacancies in December 2022. We now expect job openings to fall below their pre-pandemic peak by this summer.

BlackRock

December U.S. jobs data out this week should signal how much more the labor market needs to normalize. Slower jobs growth is a long-term supply constraint.

Previous Release

On December 8th at 08:30 ET, the BLS released the last Nonfarm Payrolls and Unemployment Rate numbers, representing the month of November.

NFP came in above expectations, at 199K, on estimates of 183K, and a prior of 150K.

However, the Unemployment Rate came in lower than expected, 3.7%, on the estimate and prior read of 3.9%.

As pictured, this caused strength in the dollar and weakness in the S&P 500.