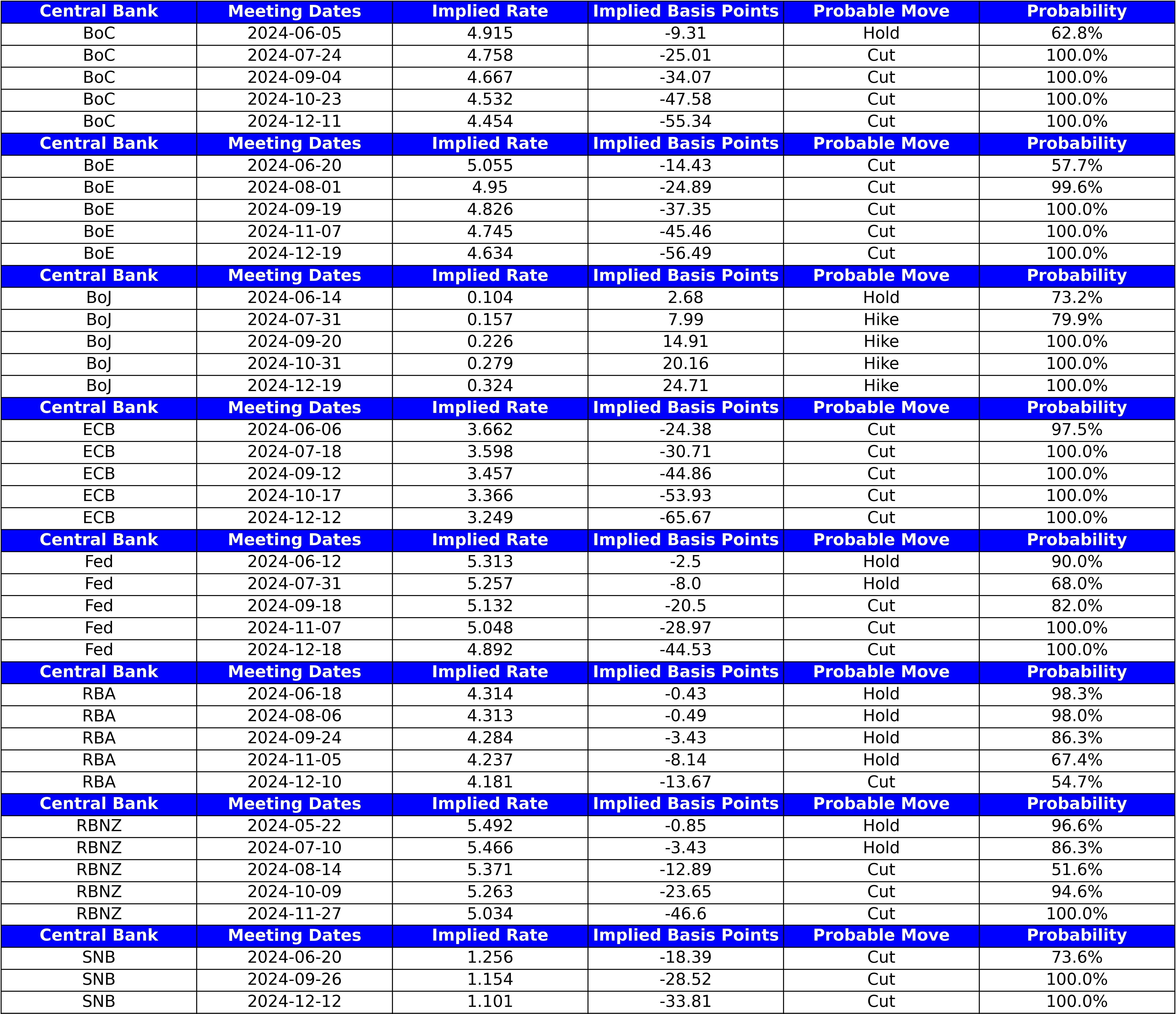

Implied interest rate probabilities for major central banks - FJElite

Why is this information useful?

It's one of the first places we look to find potential trading opportunities with incoming risk events. Knowing what markets have priced and are expecting for central banks helps us determine what type of scenarios or outcomes would offer big enough surprises that are worth exploiting.

Very high probabilities of outcomes mean less focus on the rate itself and more focus on the statement and guidance.

While probabilities closer to 50% for policy outcomes increases chances of surprises both ways.

Feedback