Sentiment Shift - FJElite

Interestingly, after the cool economic data we have seen today (most notably the ISM report, which showed prices increasing but employment decreasing sharply) we have seen interest rate futures increase bets on Fed rate cuts this year, but we have seen stocks moving down consistently during the session today.

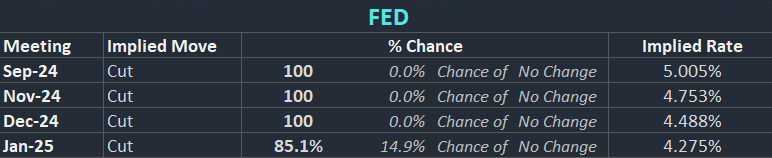

The next 3 meetings are now fully priced in as rate cuts by the markets (75 bps of cuts by the year-end), that is 50 bps more tightening this year than the median FOMC member expected in the latest SEP.

While policy easing typically benefits corporate America, broader-based economic concerns are driving equities lower.

After the Fed left rates unchanged yesterday, the markets may be getting worried that the economy is going to take a turn for the worse between now and the next FOMC meeting, and the risks of cutting rates too late may be realised, meaning a soft landing for the economy may become harder to reach.

Keep in mind that, if this shift in sentiment is fully realised, the way market reacts to economic data from here on out may become different, as we enter the next stage of the economic cycle, the easing cycle.

This means the potential goodbye to 'good news is bad news' and 'bad news is good news' scenarios we have grown so used to.