US ISM Digested: Still Expansion in the Service Sector - FJElite

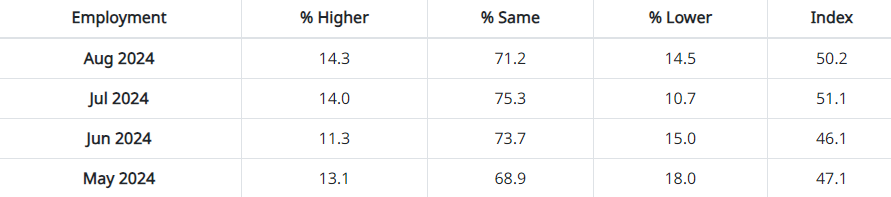

The US ISM numbers were quite strong overall, but not quite enough to boost sentiment for US stocks after a modest decrease in the employment index, despite it remaining in expansionary territory.

Despite an increase in the prices paid component, indicating higher inflation, as well as the aforementioned slight drop in employment, there were some good news to gleam.

The headline Services PMI came in higher than expected, aided by a marked increase in New Orders, moving up to 53 from expectations of 51.9.

This indicates a stronger-than-expected demand for services in the US, which highlights a resilient consumer that decreases the chances of a recession in the US.

The increase in the prices paid component likely contributed to the strength in the dollar and the US bond yields, as it works against rate cut expectations, while the whipsawing in the S&P 500 was likely caused by the stronger picture overall for the service sector, combined with the increase in prices paid.