MUFG: Commodities - FJElite

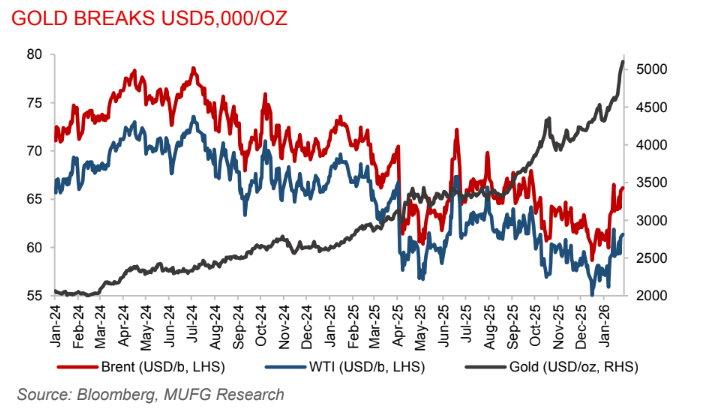

Oil holds firm as Black Sea flows resume and Iran risks linger. Oil prices steadied as markets balanced the resumption of operations at a key Black Sea export terminal against renewed geopolitical risks linked to Iran. Brent traded below USD66/b and WTI near USD61/b after last week’s sharp rally, as the Caspian Pipeline Consortium restored an offshore mooring, easing concerns over Kazakhstan’s crude exports. At the same time, President Trump’s renewed threats toward Iran and the deployment of US naval assets in the Middle East added a risk premium, prompting hedge funds to raise bullish positions to their highest level since August. While prices have advanced early this year despite expectations of a global supply glut, traders are also monitoring weather-related disruptions in the US, where freezing conditions have curtailed some refining operations and lifted natural gas demand.

Gold breaks USD5,000 as geopolitical turmoil and currency fears supercharge haven demand. Gold surged beyond USD5,000/oz for the first time, extending a powerful rally driven by escalating geopolitical tensions, a weakening dollar, and growing investor distrust in sovereign bonds and currencies. Gold climbed more than 2% to above USD5,085/oz, while silver also jumped to fresh record highs above USD100/OZ, supported by strong global retail demand. Recent US policy action, including renewed attacks on the Fed, threats of sweeping trade tariffs, geopolitical brinkmanship, and signs of stress in major bond markets such as Japan, have reinforced gold’s role as a barometer of market fear. Expectations that the next US Fed chair could adopt a more dovish stance, alongside swelling public debt in advanced economies, have further strengthened the appeal of non-yielding precious metals as a store of value.